Introduction

There is a global race towards meeting the climate goals of the Paris Agreement, and the fast adoption of renewable energy resources is the key to winning. However, the quick commissioning of wind and solar power into the grid poses challenges to the grid’s stability and reliability, as energy supply becomes highly volatile. Battery Energy Storage Systems (BESS) have emerged as the most suitable option for providing short-term flexibility to combat the volatility in power systems.

The need for BESS is exceptionally high in Finland because the country has set one of the world’s most aggressive climate targets. The government has a legal obligation to reach carbon neutrality by 2035. Renewable energy sources account for over 50% of electricity production, and several renewable projects are being planned or developed. This changing supply-demand dynamic makes the Finnish market one of Europe’s most volatile energy markets right now. The volatile market provides attractive earning possibilities for BESS operators. For example, Finnish investment company Exilion achieved 40,700€/MW/month in the second half of 2023.

In 2024, 113 MW BESS projects are expected to become operational, and 359 MW industrial-scale BESS projects have already been announced for the next five years (Elinkeinoelämän Keskusliitto, 2024). Moreover, the Finnish government is improving policy support with tax exemptions for certain green investments, including battery storage, to meet the climate targets. These policies will help to accelerate BESS investments further by making them even more attractive financially.

Renewable Energy in Finland

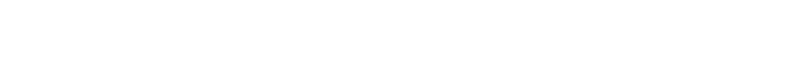

Finland has set one of the world’s most aggressive climate goals, with a legal obligation to reach carbon neutrality by 2035 (International Energy Agency, 2023b). The electricity sector will be crucial in achieving this target, and Finland has already made significant progress. Today, renewable energy sources account for more than 50% of electricity production (Statistics Finland, 2022). Moreover, the nation has one of the lowest electricity generation carbon intensities among IEA member nations (International Energy Agency, 2023b).

Share of energy from renewable sources by country

Source European Energy Agency (2024)

Finland intends to boost electricity generation and heat production from renewable sources, increase nuclear energy, and electrify most of the country’s energy demand to achieve carbon neutrality. The government has taken several steps to further enhance the demand for electrified energy. Additionally, Finland has had to quickly end its reliance on Eastern energy imports, significantly impacting domestic renewable energy production and efficiency improvements. (International Energy Agency, 2023b)

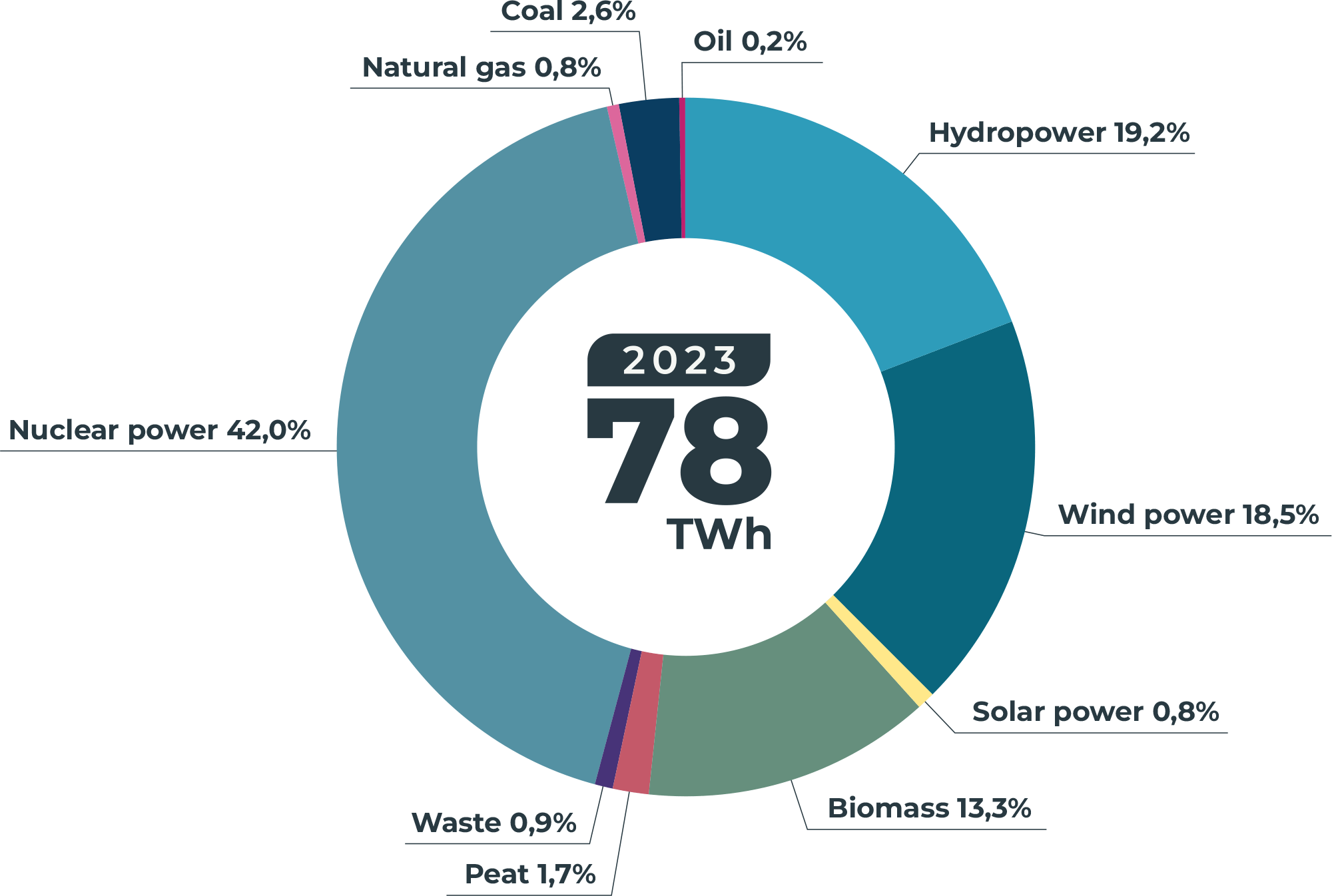

Finland’s electricity production

Source: Energiateollisuus (2024)

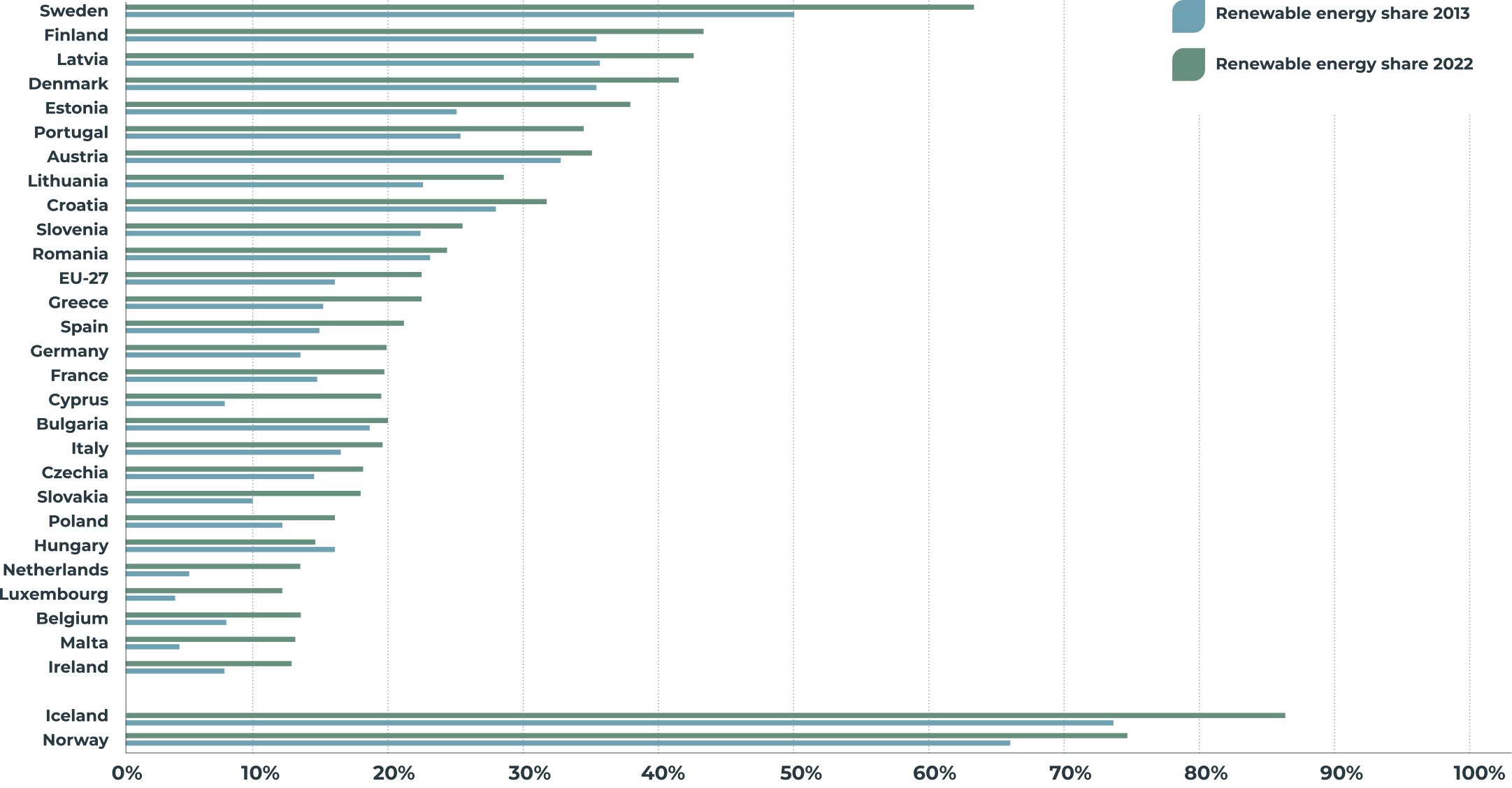

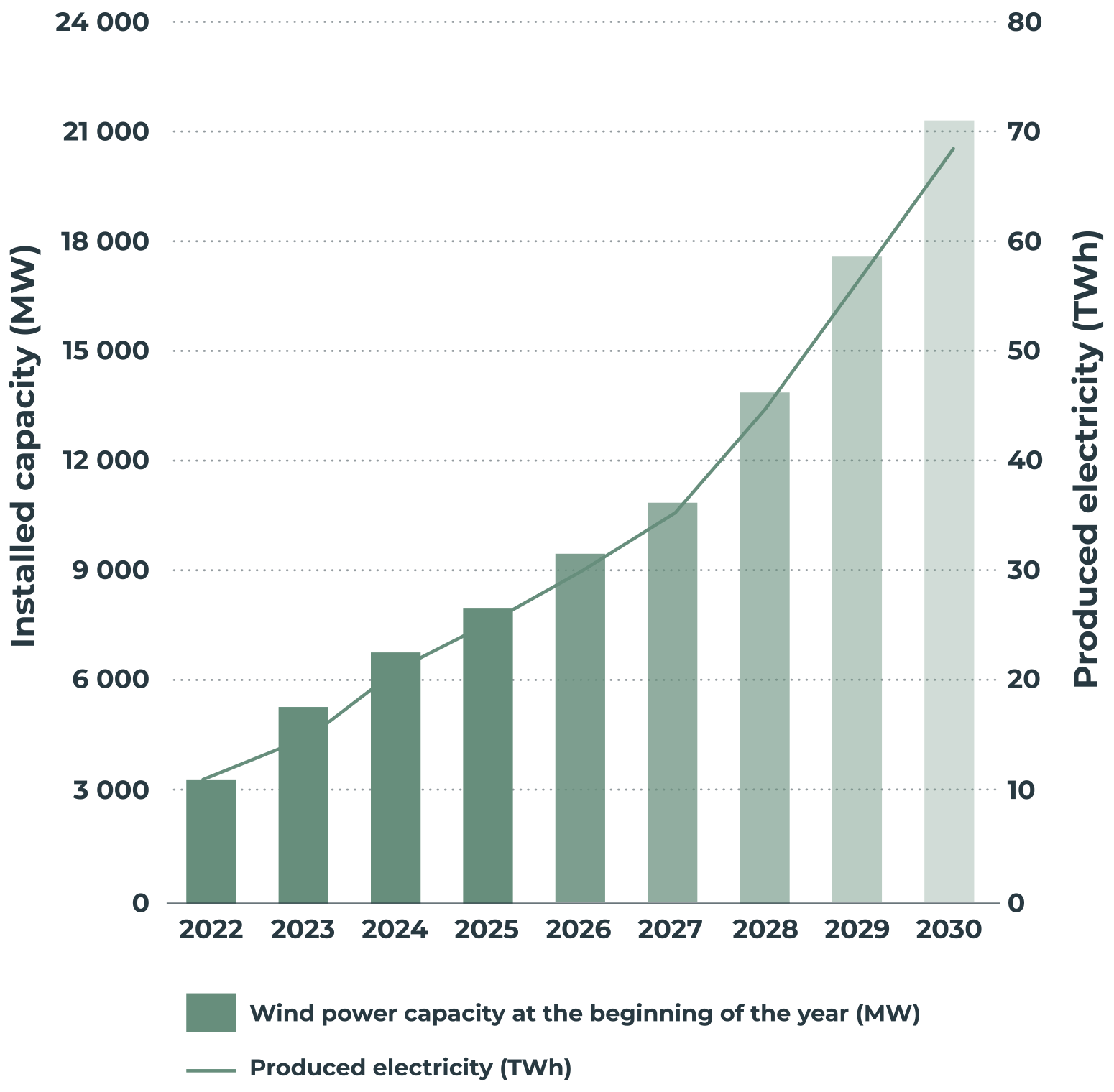

Finland has five operating nuclear reactors, providing 42% of the electricity (Energiateollisuus 2024). Hydropower supply has historically been high, but during the past ten years, the country has also seen a rapid development of wind power (Statistics Finland, 2022). Moreover, solar power is anticipated to grow massively over the next few years (Fingrid, 2024d). The Finnish government has implemented policies and incentives to promote renewable energy projects, making wind and solar even more attractive energy sources. Some of the key policy goals for the electricity sector include maintaining the growth of wind generation and boosting the deployment of solar PV systems (International Energy Agency, 2023b). Moreover, the costs of wind turbines and solar panels have declined rapidly in the past years, making the projects more profitable.

Finland’s wind and solar power growth forecast

Source: Fingrid (2024d)

As wind and solar generation take a larger share of the total energy supply, the Finnish grid becomes more unstable. Finland’s power system stability has traditionally been supplied by conventional power plants and hydropower. However, the transformation in the power generation mix creates a greater need for other sources of flexibility. BESS are excellent alternatives because of their capability to charge and discharge energy.

Finnish Electricity Market

The Finnish electricity market is part of the Nordic, the most integrated and liberalized electricity market globally (International Energy Agency, 2023b). The Electricity Market Act of 1995 opened Finland’s electricity market to competition (Ministry of Economic Affairs and Employment). Today, the market is divided into wholesale and retail markets. The wholesale market includes electricity generation, transmission, and wholesale trading, while the retail markets involve the sale of electricity to consumers. (International Energy Agency, 2023b)

The Finnish power system is part of the Nordic power system, meaning that electricity can physically and continuously flow from one country to another (Fingrid, 2024a). The Nordic System Operation Agreement includes common operating principles used by all TSOs in the Nordics (International Energy Agency, 2023b). The power system is also connected to the Central European and Baltic power systems through direct current connections (Fingrid, 2024a).

Finland’s transmission and distribution grid is well-developed (International Energy Agency, 2023b). Fingrid, the Finnish national electricity transmission system operator (TSO), is responsible for maintaining the main grid (Fingrid, 2024a), coordinating cross-border trading, maintaining the system balance, and managing electricity transmission within Finland and the Nordic countries. The Energy Authority has regulatory responsibility over the Finnish electricity market (International Energy Agency, 2023b). Nord Pool serves as the leading platform for electricity trading.

Finland is a very energy-intensive society compared to other EU countries due to the coldest climate in the European Union. Moreover, Finland has a significant industrial base, demanding much energy for its operations. The resource-intensive industries, such as forestry and paper manufacturing, also require high energy levels. In addition, the distances within the country and between the most relevant export countries are long. The energy intensity further increases the strain on the grid during high demands and necessitates solutions that help manage peak loads, improve grid stability, and optimize energy use. (Ministry of Economic Affairs and Employment, 2020)

Energy Storage is increasingly important in the Finnish electricity market, supporting the transition towards a more sustainable electricity system. BESS owners can participate in the Nordic wholesale electricity market, operating on a joint Nordic power exchange called Nord Pool. BESS operators can also participate in cross-border markets to provide storage capacity for ancillary services, such as frequency regulation, which helps maintain grid stability and reliability.

Ancillary Markets

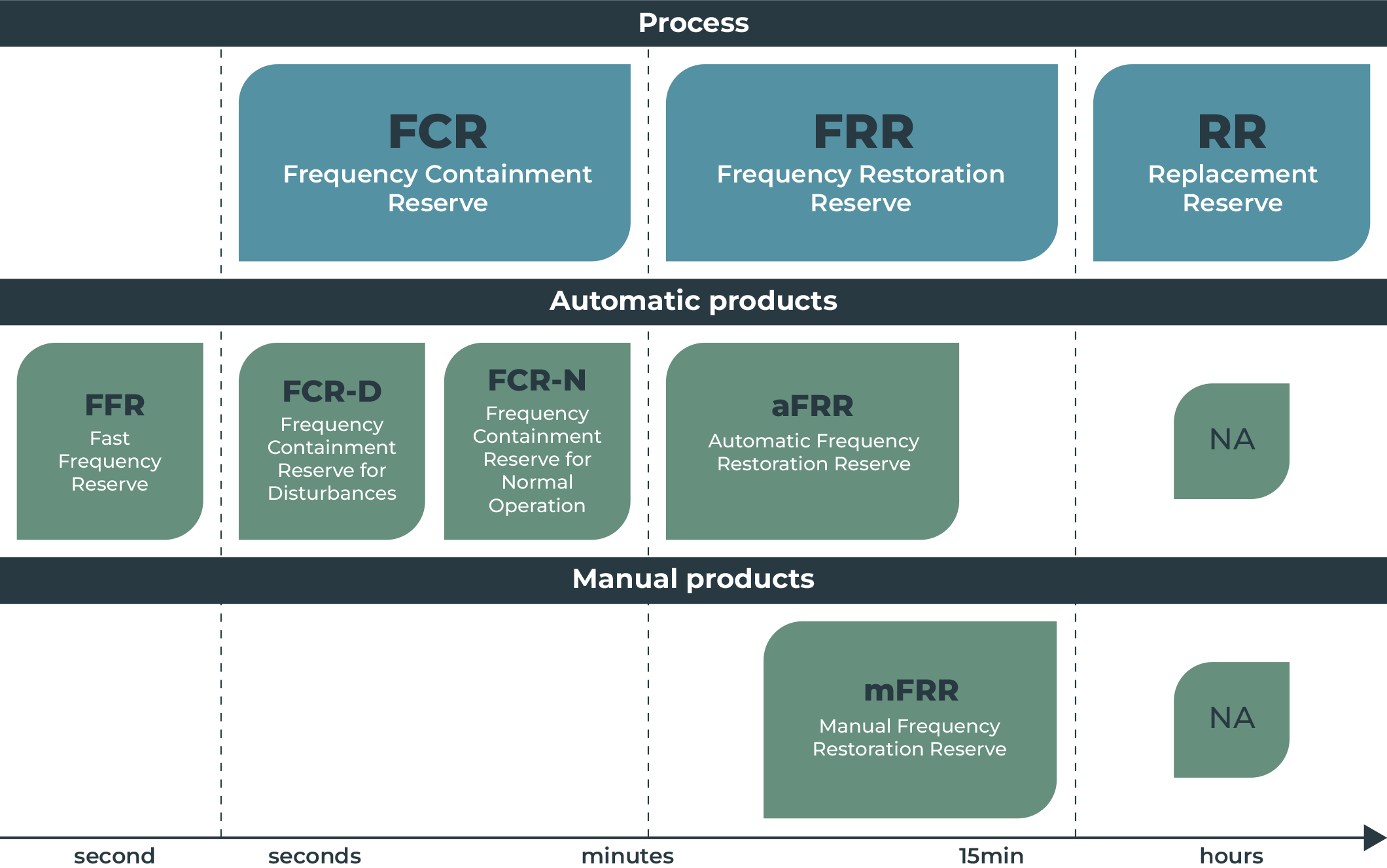

Ancillary services are currently the primary revenue source for BESS in Finland. They are the key to maintaining the grid’s stability, reliability, and power quality. Electricity production must be continuously equal to its consumption, and to balance the deviations, Fingrid procures different types of reserves from the reserve markets (Fingrid, 2024c). Currently, the following reserve products are in use: FFR (Fast Frequency Reserve), FCR-D (Frequency Containment Reserve, Disturbances), FCR-N (Frequency Containment Reserve, Normal Operation), aFRR (Automatic Frequency Restoration Reserve), mFRR (Manual Frequency Restoration Reserve).

Reserve products in Finland

Source: Fingrid (2024c)

Whereas hydropower historically provided most ancillary services, the transition towards wind and solar has increased the need for fast-acting services. Fast Frequency Reserve (FFR) was introduced in the Nordics in 2020 to address this problem (Entso-E, 2019). The introduction of FFR created a market opportunity for fast-responding assets and is expected to play an additional role in accelerating the implementation of BESS and be more critical in the future BESS revenue stack. However, the need to procure FFR depends on the electricity system’s inertia; thus, it is procured only for specific hours, and the volume varies. For the past year, the procurement amount has still been low.

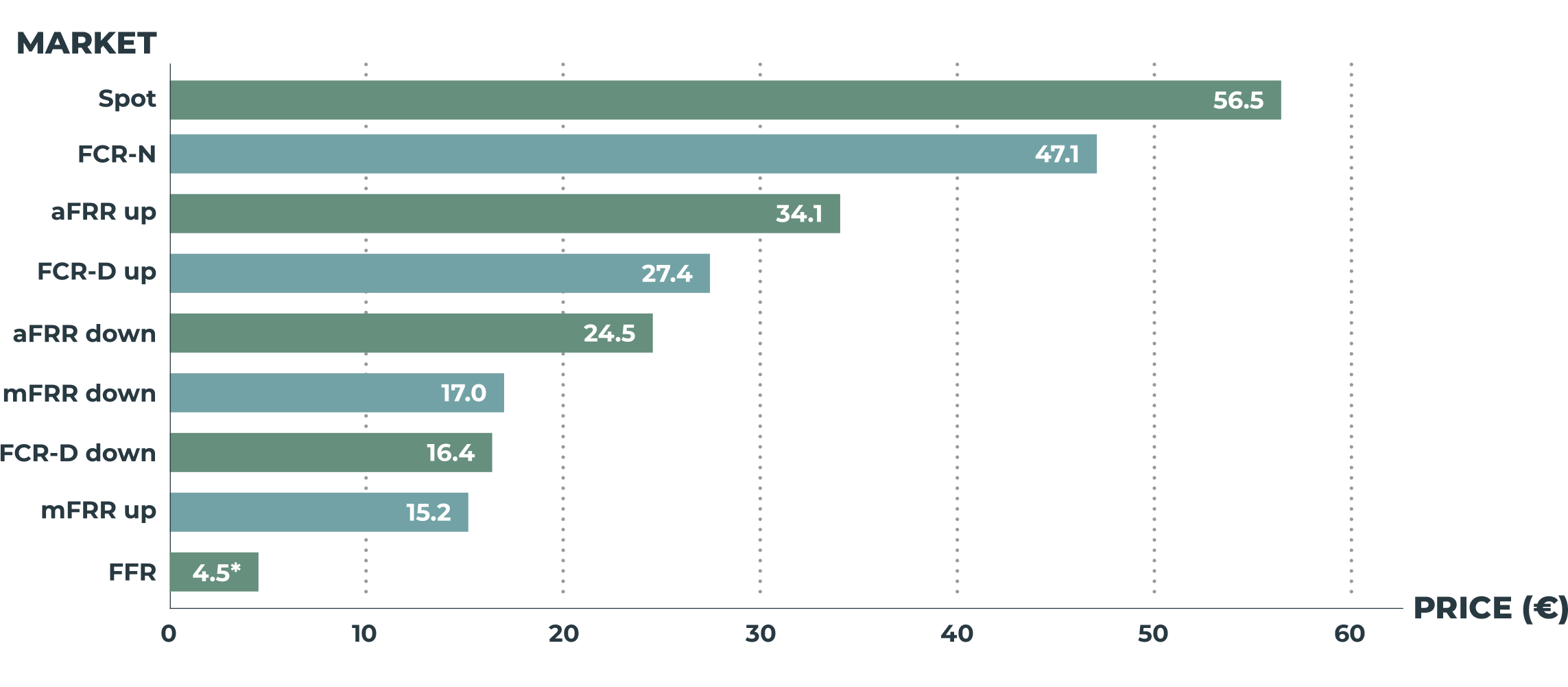

Average Market Prices in 2023

*Price is calculated as an average of all hours, including when FFR was not procured. Between 1.5.2023 and 1.5.2024, the average procured volume was 2MW, and the average hourly price was 4.5€/MW. If only the hours when FFR was procured were counted, the average price would be 38€/MW.

Source: Capalo AI 2024

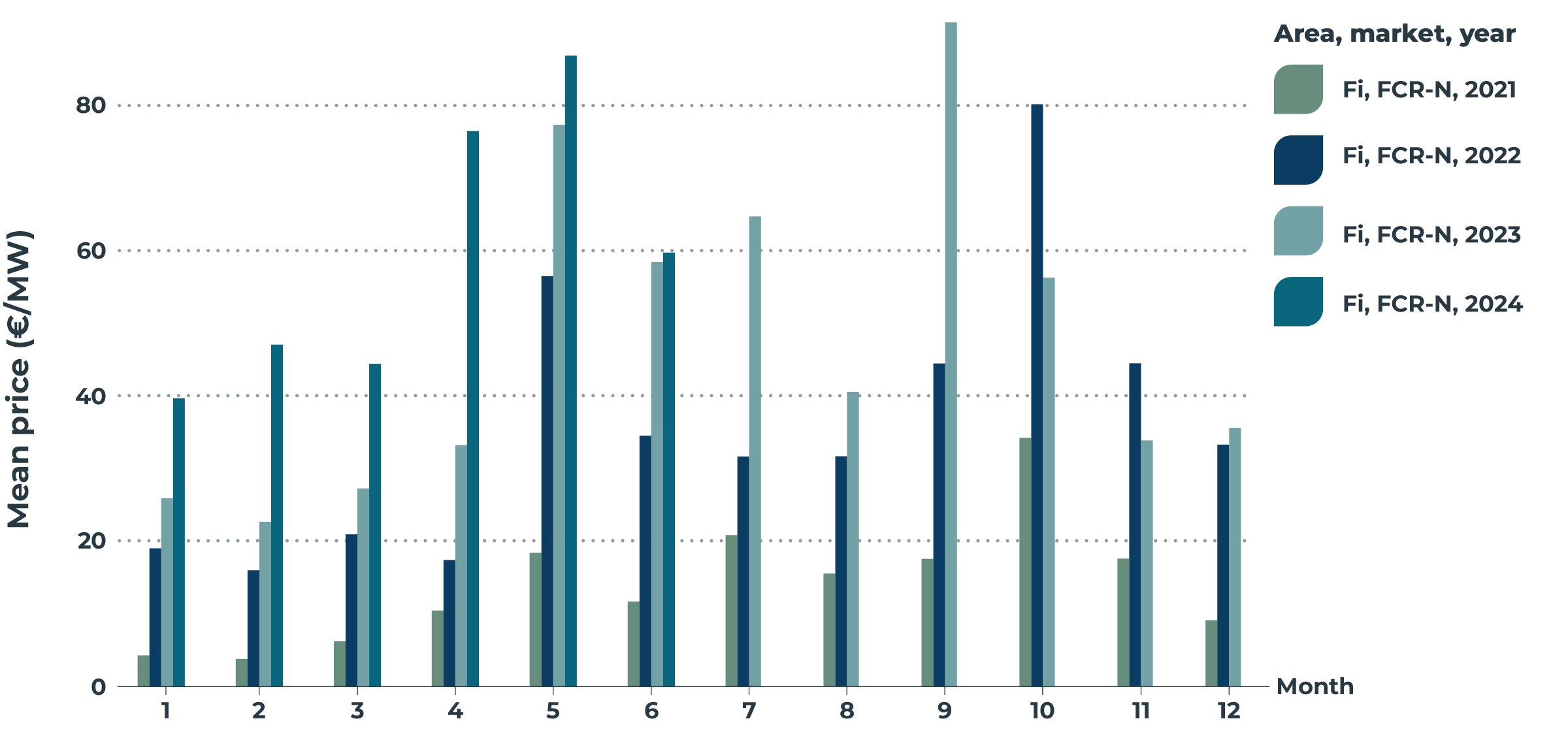

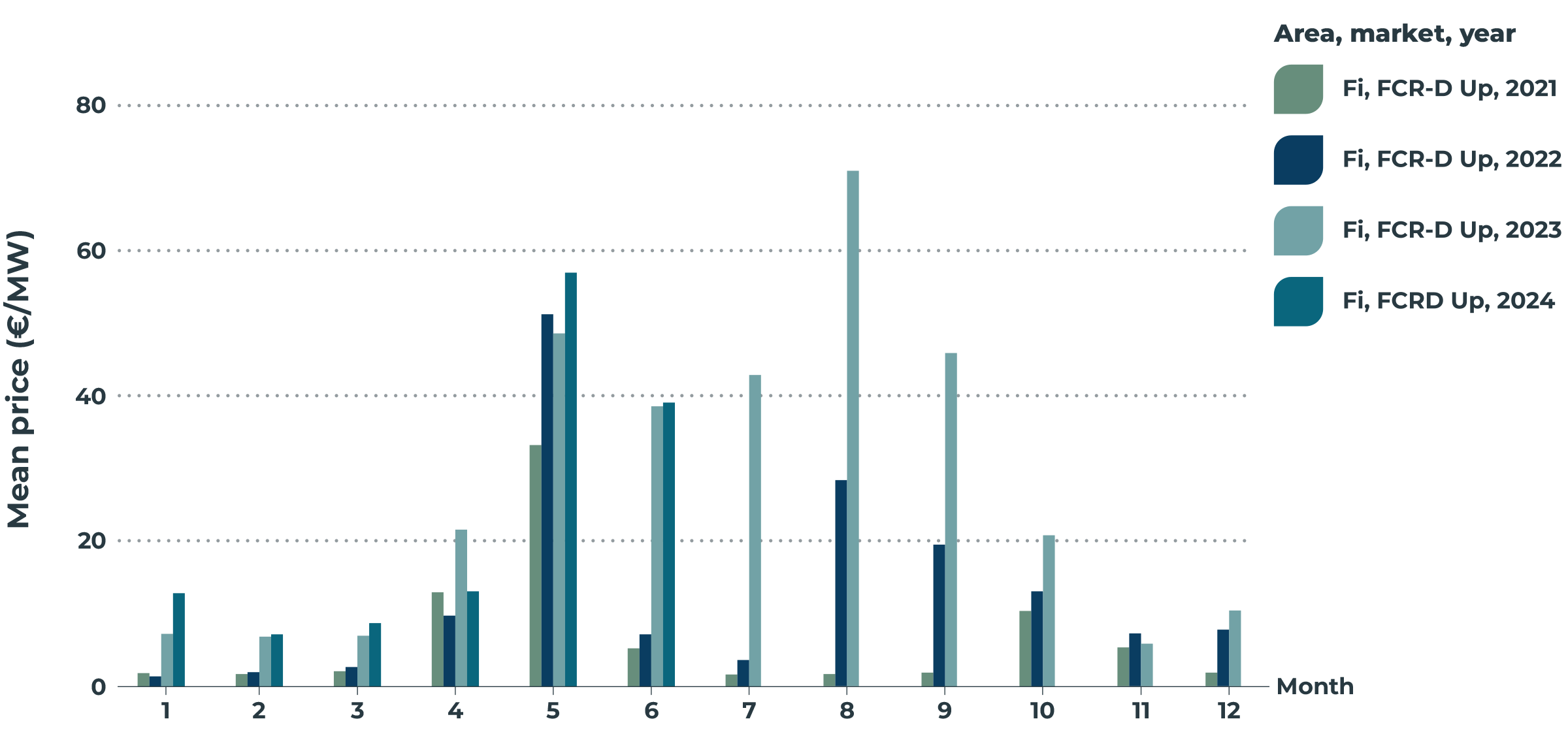

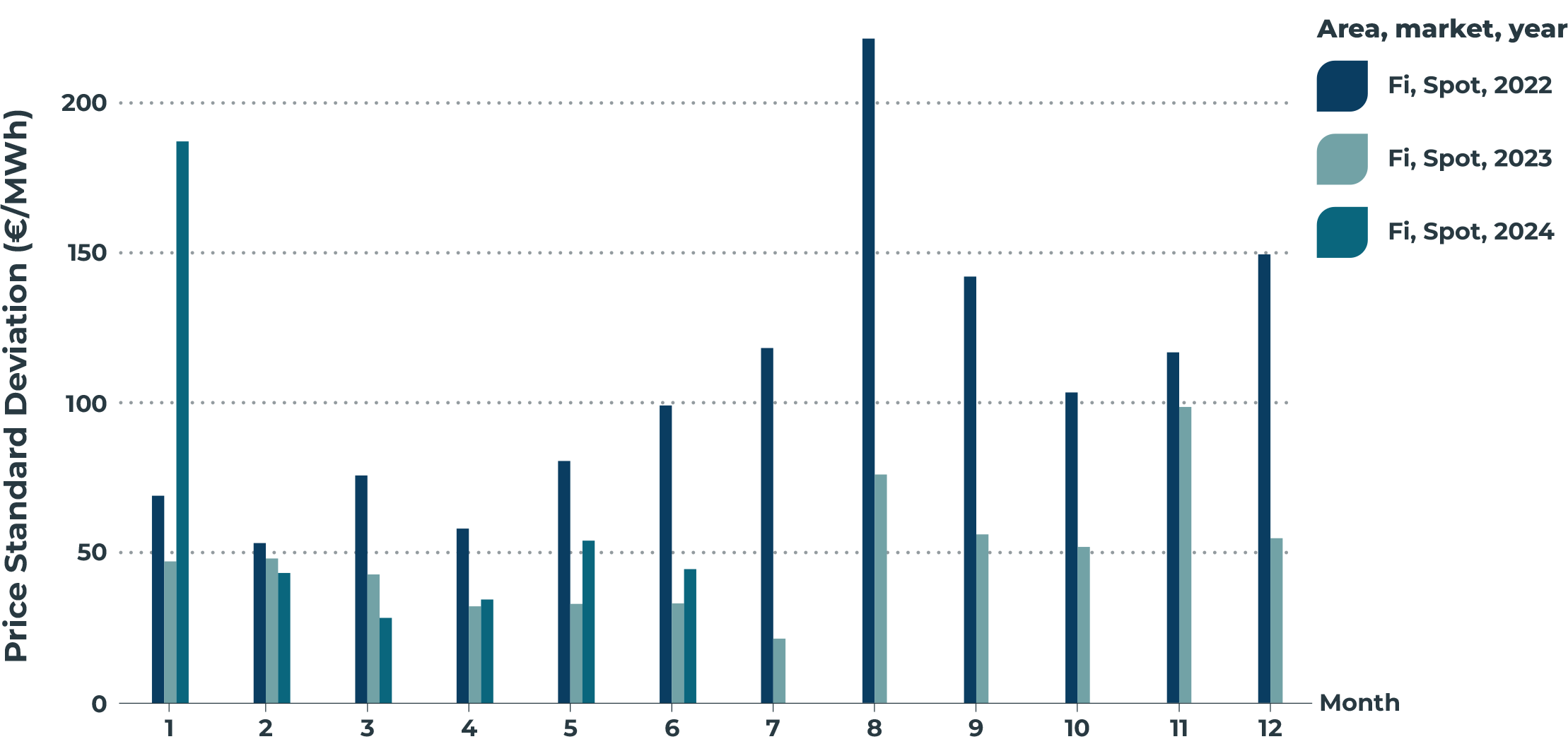

Today, BESS’s most significant revenue sources in Finland are frequency containment reserves (FCR-N, FCR-D up, and FCR-D down). Prices of FCR-N and FCR-D up have continuously increased for the past few years. Fingrid procures these reserves based on competitive bidding from the yearly and hourly markets. The hourly markets are significantly more profitable and the main earning channel for BESS assets. The tables below present the mean prices of the hourly market FCR-N and FCR-D up.

Overview of FCR-N Hourly Market Mean Prices

Source: Capalo AI 2024

Source: Capalo AI 2024

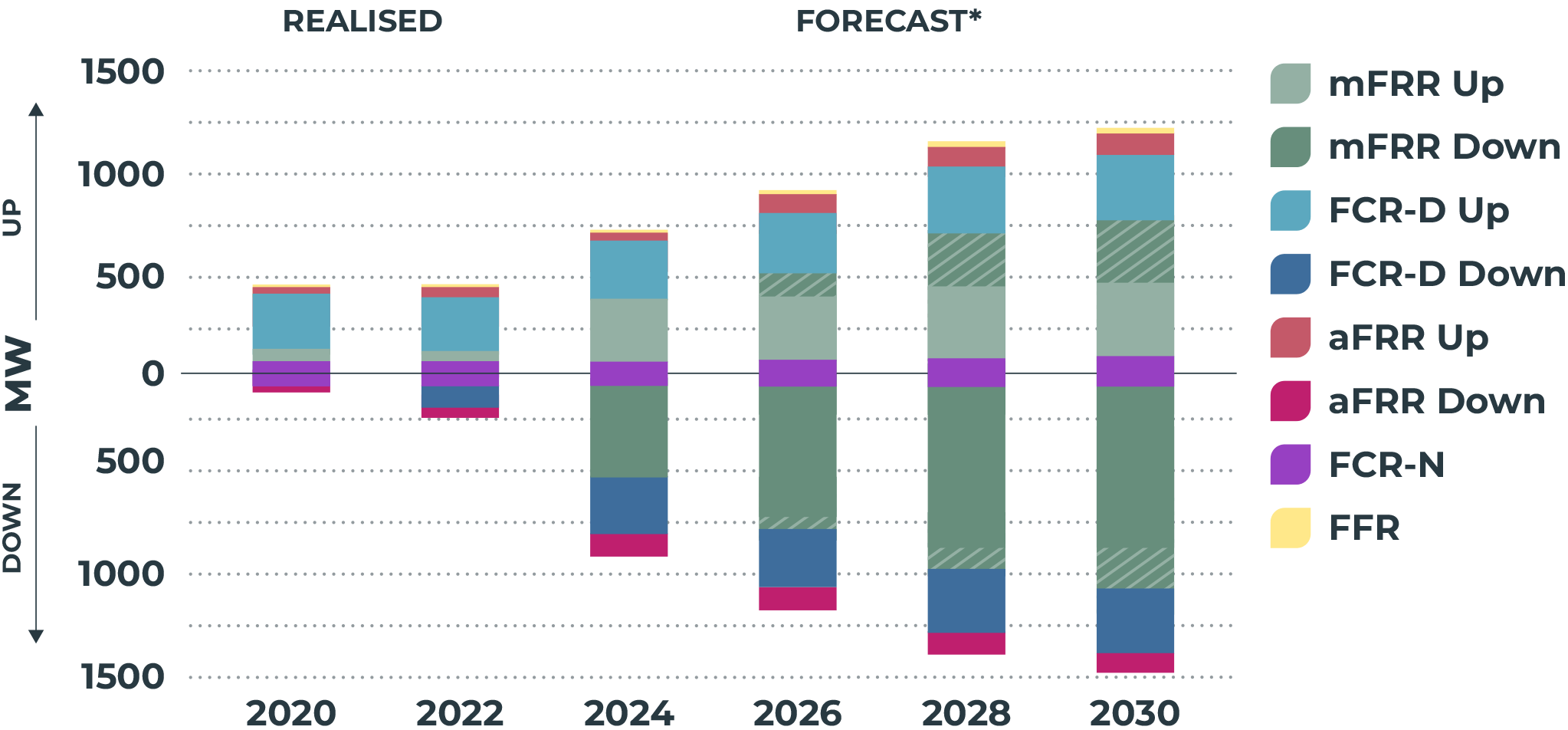

The energy revolution has enormously impacted the Finnish ancillary services market, and the need for reserve capacities is expected to grow 134% within the next five years (Fingrid, 2024b). mFRR up procurement will increase once the contracts with reserve power plants end, and FFR is needed more frequently. The procurement of mFRR is expected to proliferate, yet the uncertainty of its forecasting is high (ibid). Once the Nordics enter the European aFRR energy market (PICASSO), the aFRR procurement is also expected to grow significantly (ibid).

Purchase quantities of reserve capacity 2020 – 2030

Source: Fingrid (2024b)

There are currently around 70 companies participating in the ancillary markets, but since the need is growing fast, there is room for more suppliers. Hydropower still provides many ancillary services today, but other reserves are increasingly participating in the market. The need is primarily for wind power, consumption, various sizes of BESS, and solar power.

Due to the high need for more reserves, the Finnish TSO, Fingrid, is encouraging new participants to enter the market. It has made the market more accessible, developed the technical system of the ancillary markets to be more compatible with different types of technologies, and lowered the minimum bid from 5MW to 1MW (Fingrid, 2024b). The only exception is mFRR, whose minimum bid remains at 5MW until the end of 2024, when it will also change to 1MW. These changes enable smaller-scale BESS to participate in the ancillary market. In addition, smaller-scale BESS can also participate in the markets as part of a Virtual Power Plant (VPP). By aggregating smaller resources, VPPs create a unified network to participate in the markets as one larger virtual unit.

Before participating, the supplier must undergo a prequalification process. This process ensures that the reserve units satisfy the requirements related to the service the supplier wants to provide. Fingrid determines the technical requirements and prequalification process for each ancillary service market. The Balancing Service Provider (BSP) performs the prequalification tests following Fingrid’s process. The prequalification includes controlling parameters such as the reserve capacity, activation capability, and endurance time. (Fingrid, 2021, Fingrid, 2024b)

Wholesale Markets

Finland is part of the Nordic wholesale electricity market, comprising the Nordic and Baltic countries (International Energy Agency, 2023b). Nord Pool, the Nordic power exchange, facilitates electricity trading across the countries through day-ahead (spot) and intraday markets. Nordics has the world’s most harmonized cross-border electricity market; however, an ongoing project is to create a single European internal electricity market, enabling electricity to move freely from one member state to another (International Energy Agency, 2023b). Being part of a larger electricity market improves efficiency. It creates more trading opportunities, and for BESS operators, this means access to a broader range of market segments and the potential for higher revenues.

The wholesale market manages spot and intraday electricity trading between the interconnected European bidding zones (International Energy Agency, 2023b). Finland is a single bidding zone, whereas other Nordic countries are divided into multiple bidding zones. The single bidding zone provides many benefits for BESS operators, as it lowers the complexity and the cost of market operations and simplifies the participation in ancillary services.

Day-Ahead (Spot) Market

The day-ahead market facilitates the trading of electricity for the next day. The Finnish day-ahead market uses hourly pricing but is transitioning towards 15-minute trading intervals, which should be in place from the start of 2025. BESS operators will benefit from more frequent trading intervals. Unlike other traded flexible energy resources, with BESS, you can fully determine when to dispatch on a day-ahead basis, resulting in enhanced flexibility and predictability in energy management. In addition, the shorter intervals allow better optimization of arbitrage strategies through smaller, yet more frequent, price differentials. The role of BESS in balancing the grid will also be improved with the shorter intervals.

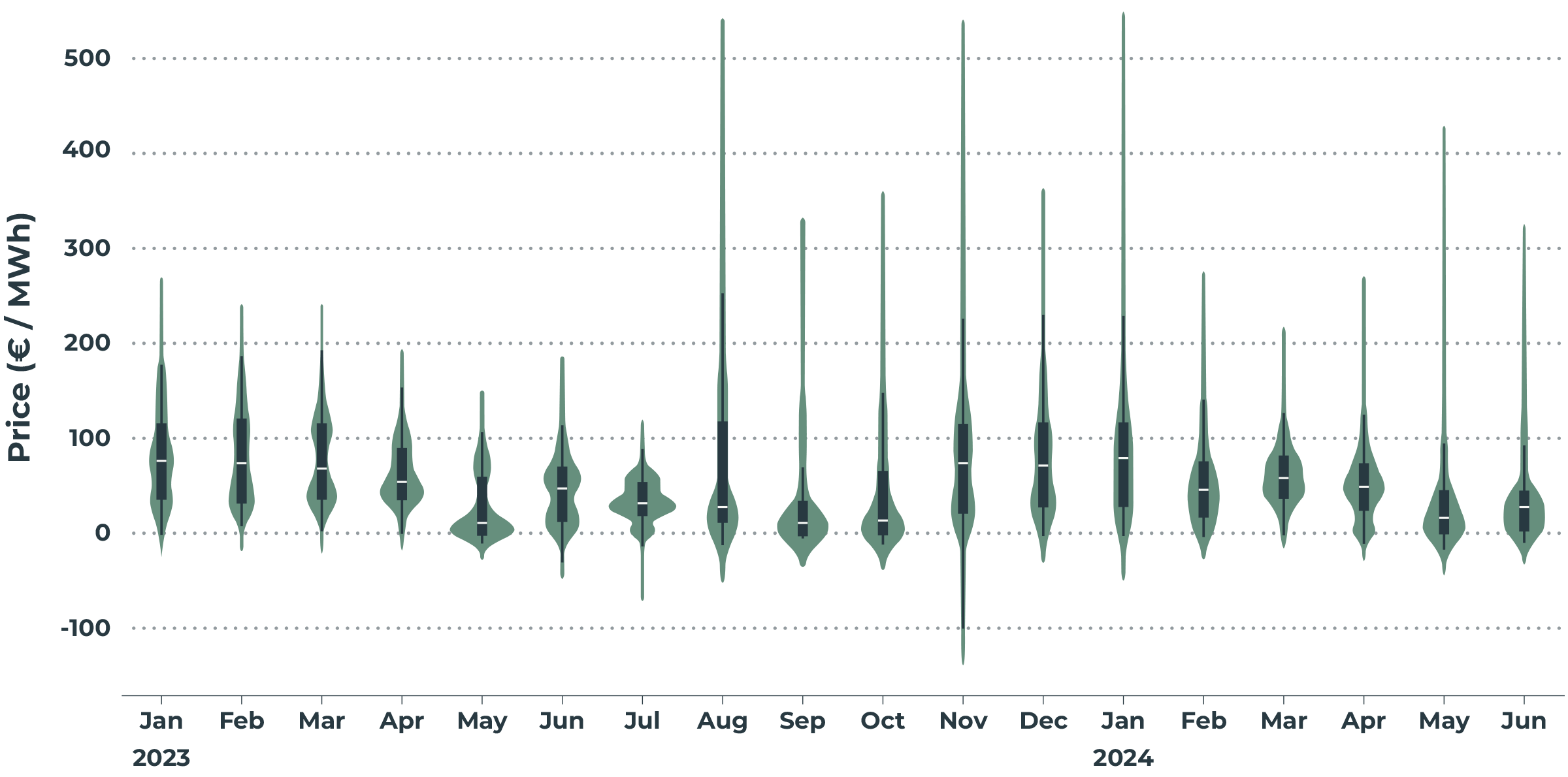

The day-ahead prices in Finland have been very volatile for the past years (International Energy Agency, 2023b), making the market very favorable for BESS. The market is based on a marginal clearing method, and the intersection of the supply and demand price-volume curves determines the price. Accordingly, prices become negative when there is excess supply and lack of demand. In 2023 and 2024, Finland had the most negative price hours in Europe. Some leading causes were the rising renewable energy generation, fixed feed-in tariffs, the addition of the Olkiluoto 3 nuclear plant in 2023, and the return of Olkiluoto 3 from its annual maintenance in May 2024. Olkiluoto 3 has a capacity of 1.6 GW and produces 14% of the electricity in the country.

In addition to the low prices, Finland has seen some of the highest day-ahead prices in Europe in the past years. Some of the reasons behind the high prices were the unexpected drop in nuclear generation in Finland at the end of August 2023 and the Olkiluoto 3 nuclear plant maintenance between March and May 2024, which took twice as long as initially expected. During both incidents, the wind generation was also extremely low. The nuclear plants’ outages forced Finland to rely on coal, peat- and gas-fired power plants and increased imports from the neighboring countries.

Spot Day-Prices by Month

Source: Capalo AI 2024

*Outliers of -500 EUR/MWh from November 2023 and prices from January 2024 above 500 EUR/MWh are excluded from this plot.

Source: Capalo AI 2024

For BESS operators, volatility creates arbitrage opportunities—generating revenue by optimizing trading by buying low and selling high to maximize profit margins. BESS traders can also benefit from load shifting and hedging against volatility when it is high.

Intraday Market

The intraday market provides more flexibility to market players to balance their electricity production and consumption closer to real-time, support the balancing of the power system, and optimize trading portfolios. It is a continuous power exchange where participants can buy and sell energy for future hours, 30- and 15-minute blocks in real-time. Interest in the intraday market is increasing as more renewable energy sources are being integrated, making it more difficult for market participants to be in balance after the closing of the day-ahead market. (Nord Pool 2024)

Nord Pool’s intraday market operates in 14 countries. Prices are set on a first-come, first-served basis, with the highest prices buying first and the lowest selling first. Capacity in Finland is provided by Fingrid and is determined after the day-ahead auction. (Nord Pool 2024)

BESS operators can generate revenue by buying at lower prices and selling at higher prices in the intraday market to help manage grid imbalances and smooth fluctuations in supply and demand. Intraday prices often fluctuate around day-ahead prices, reflecting the expected supply and demand conditions. However, if the actual demand and supply differ, the intraday prices adjust accordingly. When the intraday prices are significantly lower or higher than the spot prices, BESS operators can benefit from arbitrage opportunities. BESS traders need to act very quickly to realize these transactions, especially on intraday markets. In asset-backed intraday trading, the BESS acts as insurance against monetary loss if the market does not behave as expected. Accordingly, in situations where prices increase after the purchase of electricity, the BESS operator can activate the asset to avoid making a loss, and vice versa.

Investing in BESS in Finland

Finland has highly supportive policies and power market designs for BESS, and the country has announced its plans to introduce a temporary tax exemption to boost investments in the renewable sector. The tax exemptions will be limited to 20% of a project’s value, up to 150 million euros. This commitment to supporting the green transition signals the government’s dedication to fostering a favorable investment environment. The goal is to encourage emissions-free industrial growth and development, and exemptions will be granted by the end of 2025 for new projects with final investment decisions. (Valtioneuvosto, 2024)

Finland has just under 100 MW of operational BESS capacity today (Elinkeinoelämän Keskusliitto, 2024). By the end of 2024, 113 MW BESS projects should be completed, and in the next five years, 359MW industrial-scale BESS projects have already been announced (ibid). The rate of foreign investments in BESS projects in Finland is also increasing. The prices of frequency containment ancillary services are currently very high, and there is a fundamental need for more energy storage in the grid as the country continues to grow renewable energy production. For example, a Finnish investment company Exilion, earned 40,700€/MW/month with their 6MW/6.6MWh BESS in 2023 using Capalo AI’s optimization.

Some of the most significant BESS projects include Taaleri Energia’s 30MW/36MWh BESS in Lempäälä and Ardian’s Mertaniemi 38.5MW/38MWh BESS in Lappeenranta. Capalo AI will optimize both to maximize revenue streams and ensure maximum asset lifespan. Both BESS will be traded in all Finnish ancillary markets and Nord Pool wholesale markets. As discussed, wholesale and ancillary markets serve different purposes in the Finnish electricity market ecosystem. BESS trading strategies can—and should—leverage opportunities in both to maximize the revenue streams. Whereas the ancillary markets are BESS’s primary revenue source today, the wholesale market’s role is growing. Trading in all markets ensures comprehensive revenue streams and manages the risk of changing market environments in the Finnish reserve markets once all the projects above become operational. Participating in all markets offers a future-proof trading strategy with better revenue diversification, risk management, and market opportunities.

Conclusions

Investing in Battery Energy Storage Systems (BESS) in Finland presents a significant opportunity due to the country’s ambitious climate goals and the rapid expansion of renewable energy sources. As the country progresses towards carbon neutrality, BESS investments are expected to play a significant role in its renewable energy landscape. Moreover, due to the importance of energy storage in grid stability, Finland offers supportive policies for BESS investments.

The volatile energy market, together with the versatile ancillary and wholesale marketplaces for BESS, offer attractive revenue sources for investors. For example, investment company Exilion demonstrated substantial returns of 40,700€/MW/month in 2023 in Capalo AI’s optimization. With the right optimizer and trading strategies, investing in BESS in Finland is undoubtedly a lucrative opportunity.

About Capalo AI

Capalo AI is a sustainable tech company specializing in optimizing energy storage systems. We maximize the value of battery energy storage systems (BESS) across all electricity markets by combining the most accurate forecast data with cutting-edge AI and optimization models.

As the world accelerates its transition towards renewable energy sources to meet the Paris Agreement climate goals by 2030, the role of battery storage in ensuring grid stability and reliability is critical. Energy storage is projected to need to grow sixfold to meet these goals.

Capalo AI technology is crucial in facilitating this transition. By making BESS investments more profitable and the investment payback time much shorter, we enable weather-dependent renewable energy sources to expand rapidly and utilize their produced energy the most effectively.

References

Elinkeinoelämän Keskusliitto. (2024, April 3). Green investments in Finland – Elinkeinoelämän keskusliitto. https://ek.fi/en/green-investments-in-finland/

Energiateollisuus. (2024). Sähkövuosi 2023. Retrieved May 3, 2024, from https://energia.fi/wp-content/uploads/2024/01/Sahkovuosi-2023_paivitetty.pdf

Entso-E. (2019). Fast Frequency Reserve – Solution to the Nordic Inertia Challenge. https://www.statnett.no/globalassets/for-aktorer-i-kraftsystemet/utvikling-av-kraftsystemet/nordisk-frekvensstabilitet/ffr-stakeholder-report_13122019.pdf

European Energy Agency. (2024). Share of energy consumption from renewable sources in

Europe. https://www.eea.europa.eu/en/analysis/indicators/share-of-energy-consumption-from

Fingrid. (2021). The technical requirements and the prequalification process of Fast Frequency Reserve (FFR). In Fingrid Oyj. https://www.fingrid.fi/globalassets/dokumentit/en/electricity-market/reserves/the-technical-requirements-and-the-prequalification-process-of-fast-frequency-reserve-ffr.pdf

Fingrid. (2024a). About Fingrid: In Brief. https://www.fingrid.fi/en/pages/company/in-brief/#ef8b90c6

Fingrid. (2024b). Fingrid- lehti: Energiajärjestelmää uudistamassa. Fingrid, 27, 1-32. Retrieved May 2, 2024, from https://www.fingrid.fi/globalassets/dokumentit/fi/julkaisut/asiakaslehdet/fingrid_1_2024.pdf

Fingrid. (2024c). Reserves and balancing power. https://www.fingrid.fi/en/electricity-market/reserves_and_balancing/#reserve-products

Fingrid. (2024d) Sähköntuotannon ja kulutuksen kehitysnäkymät. Fingridin ennuste Q1/2024. https://www.fingrid.fi/globalassets/dokumentit/fi/kantaverkko/kantaverkon-kehittaminen/sahkon-tuotannon-ja-kulutuksen-kehitysnakymat-q1-2024-fingrid.pdf

Ministry of Economic Affairs and Employment. Electricity Market. Retrieved April 23, 2024, from https://tem.fi/en/electricity-market

Ministry of Economic Affairs and Employment. (2020). Finnish Electricity Market Development and Implementation Plan. https://energy.ec.europa.eu/system/files/2020-07/implementing_plan_finland_final_10072020_0.pdf

Nord Pool. (2024). Intraday Market. https://www.nordpoolgroup.com/en/the-power-market/Intraday-market/

Statistics Finland. (2022). Energy in Finland 2022. https://www.doria.fi/bitstream/handle/10024/185778/yene_efp_202200_2022_25869_net.pdf?sequence=1&isAllowed=y

Valtioneuvosto. (2024). Hallituksen Kehysriihi 15.-16.4.2024 Kasvupaketti. https://valtioneuvosto.fi/documents/10616/199806183/Kasvupaketti%2016.4.2024.pdf/c867e33b-faea-d211-b22a-3b19b2394a89/Kasvupaketti%2016.4.2024.pdf?t=1713272175558